S 543 Federal Deposit Insurance Corporation Improvement Act of 1991102nd Congress 1991 1992

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC WFCS and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker dealers and non bank affiliates of Wells Fargo and Company. The Savings Bank of Walpole has been managed and continues to be managed in a safe and sound manner with the single most important objective of protecting our depositors’ accounts. Before an advisor even begins prospecting, it’s important that they set a precise, pinpointed goal that goes beyond “get more clients. Official websites use. If you would like to comment on the current content, please use the ‘Content Feedback’ button below for instructions on contacting the issuing agency. If a couple has $500,000 in a joint account, as well as $250,000 in an eligible retirement account, the entire $750,000 would be covered by the FDIC, as each co owner’s share in the joint account is covered, and the retirement account is a different account category. Comment letters concerning proposed changes to regulations, 1975 80. For example, with the threat of the closure of a bank, small groups of worried customers rushed to withdraw their money. Start by asking to connect with people who are already connected with your clients and colleagues. The CFPB will exercise its authorities to ensure the public is protected from risks and harms that arise when firms deceptively use the FDIC logo or name or make deceptive misrepresentations about deposit insurance, regardless of whether those misrepresentations are made knowingly. Adzooma states that 35% of people say they prefer brands to talk in a friendly and conversational way.

Heart of Advice

Main Office 195 Washington Street, Weymouth, MA 02188. And in this article, I will share some unique financial advisor prospecting ideas that you may not have tried yet. Knockout Networking for Financial Advisors is the only book written for sales producers in the financial services industry focused on making more connections through networking. Although niche marketing is not a marketing channel, per se, it’s important to start the conversation about prospecting there. As a result, banks have a better opportunity to address problems under controlled circumstances without triggering a run on the bank. In Winnipeg, describes how such a relationship can work: « I deal with a real estate agent who often says to his clients: ‘I have set you up with a mortgage, but have you done a financial plan for yourself. The agency is managed by a five person Board of Directors, all of whom are appointed by the President and confirmed by the Senate, with no more than three being from the same political party. The participation rate for FY 2009 was 0. EDIE is also available in Spanish Cálculo Electrónico de Seguro de Depósitos. Please refer to the Understanding Deposit Insurance section of.

Research Guides

When it comes to getting your banking questions answered, using your mobile banking app can help you save time and even allow you to avoid fees. You’ll meet like minded people who might become clients or refer you to potential customers. Customer Assistance:1 800 613 6743Monday Friday,7:00 am 7:00 pm CT. By connecting these ideas with organizations and networks, we seek to inspire action that can unleash an era of unparalleled human flourishing at home and around the globe. NOTE: On July 21, 2010, President Barack Obama signed the Dodd Frank Wall Street Reform and Consumer Protection Act, which, in part, permanently raises the current standard maximum deposit insurance amount to $250,000. Our editors will review what you’ve submitted and determine whether to revise the article. Do something that you’re passionate about, people will notice your authenticity and want to help you. More on our Career Services. And it will https://reitour.org/REI-Tour-Initiatives-and-Projects/Mayor’s-Leadership-Academy-.aspx be routed appropriately. Start by asking to connect with people who are already connected with your clients and colleagues. My goal is to answer the following question: how does a financial advisor create LinkedIn messages and sequences that generate leads for his or her firm. Information and documentation can be found in our developer resources. Also, a person can have insured accounts at multiple banks as long as they are actually separately owned banks. For more information.

Warm Introductions and Referrals

Share sensitive information only on official, secure websites. Examples of different ownership categories include: 1 single, 2 joint, 3 revocable trust informal revocable trusts such as Payable on death accounts and formal revocable trusts such as living/family trusts created for estate planning purposes, 4 irrevocable trusts, 5 certain retirement plans, 6 employee benefit plans, 7 business corporation, partnership, unincorporated associations, and 8 government. Ranging across the fields of economics, political science, law, history, philosophy, and sociology, The Independent Review boldly challenges the politicization and bureaucratization of our world, featuring in depth examinations of past, present, and future policy issues by some of the world’s leading scholars and experts. User IDs potentially containing sensitive information will not be saved. To move your boat forward, you should prospect every day. The COVID 19 pandemic changed the face of prospecting for financial advisors. The FDIC also has a US$100 billion line of credit with the United States Department of the Treasury. According to the research published by Cerulli Associates, nearly two thirds 64% of RIAs use or have used niche marketing, and 37% consider it to be extremely effective with another 57% who have found it to be somewhat effective. That is why getting to know your target audience in terms of location, age, gender, hobbies, interests, and demographics is important before starting any prospecting activities. Most retirement accounts are insured up to $250,000 per depositor. Some retirement accounts such as IRAs are insured up to $250,000 per depositor, per insured bank. 58% Individuals with Targeted Disabilities IWTD. If you are working with a CPA, lawyer, taxman, and other professionals, the financial advisor will coordinate with them on your behalf, saving you time and effort. Slow periods can happen to any advisor, but an extended slump could be a sign that you need to rethink your prospecting tactics. Media Contact details. Every financial professional should have a clear understanding of why and how they’re prospecting, beyond the simple goal to get more clients. For more information about FDIC insured products available through Schwab’s Affiliated Banks or your Schwab brokerage account, contact us.

Historical insurance limits

“To remain competitive, advisors need to offer more services but expect to charge the same fee,” Biagini says. The FDIC provides separate insurance coverage for deposit accounts held in different categories of ownership. These are opportunities to give prospects a sample of what they need for free while opening the door to the possibility of an ongoing professional relationship. That’s where we come in, our blog posts are designed to help financial advisors succeed. Banks and thrifts in the event of bank failures. Coverage extends to individual retirement accounts IRAs, but only the parts that fit the type of accounts listed previously. Similarly, some advisors can see amazing results with dinner seminars, while others might use the exact same materials and fail. Although the majority of banks and thrifts belong to FDIC, many do not, so it’s important to verify if the institution is an FDIC member before opening an account. That’s why it’s crucial that you establish what sort of messaging you want your brand to have, what values you’d like to be known for, and what sets you apart from other advisors. For example, if an individual has an IRA and a self directed Keogh account at the same bank, the deposits in both accounts would be added together and insured up to $250,000. Financial advisory firms with many referrals are associated with excellent customer service and support that clients are looking out for. Inputting an RSSD ID will trump any other search criteria. 12% in the participation rate of employees with targeted disabilities. You need to sound fluent, confident and convincing.

The Most Important Ages for Retirement Planning

“Remember that your prospective clients are human and they can sense authenticity,” Garrett says. Start by asking to connect with people who are already connected with your clients and colleagues. The FDIC Standard Maximum Deposit Insurance Amount SMDIA for deposits is $250,000 per depositor per insured financial institution, for each ownership category. Get our mobile banking app. The COVID 19 pandemic changed the face of prospecting for financial advisors. By Jane Wollman Rusoff. Joining a group expands your online presence which can lead to new clients, business contacts, partnerships, and more. That’s why prospecting is such a critical aspect of running an advisory business. Some retirement accounts such as IRAs are insured up to $250,000 per depositor, per insured bank. Each ownership category of a depositor’s money is insured separately up to the insurance limit, and separately at each bank. This is a sentiment Garrett shares. Filling the funnel with a constant flow of qualified leads has long been the biggest challenge facing advisors, regardless of how long they’ve been in the business. Insured banks are assessed on the basis of their average deposits; they are currently allowed pro rata credits totaling two thirds of the annual assessments after deductions for losses and corporation expenses. So, if an individual owned both a savings account and a retirement account at two different banks, they would have $1,000,000 of insured deposits. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. Do something that you’re passionate about, people will notice your authenticity and want to help you. You may also call the FDIC toll free at 877 ASK FDIC that. Com, says traditional advisors are now in a race to zero fees with robo advisors. If you’re in bad standing with your local community the odds of your advisory agency being successful is very low. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. The FDIC has no authority to charter a bank, and may only close a bank if the bank’s charterer fails to act in an emergency. If the chat team is temporarily offline, please click on your region below to see alternate contact methods and hours of operation. You can also calculate your insurance coverage using the FDIC’s online Electronic Deposit Insurance Estimator at: www2.

Interact with Groups and COI Circles of Influence

To facilitate a merger, the FDIC buys the bad assets of the failing bank to make it more attractive for the acquiring bank. All financial advisors know that prospecting is the lifeblood of their business. So, it seems that the best we can do is tell you what we at the Model FA and also at SurePath Wealth offices across the country are doubling down on for financial advisor prospecting in 2020. Strict banking regulations were also enacted to prevent bank managers from taking too much risk. After all, LinkedIn is a networking site first and social media second. Although earlier state sponsored plans to insure depositors had not succeeded, the FDIC became a permanent government agency through the Banking Act of 1935. ” Another option is to use an advocate search, which entails looking at the connections of connections, and filtering the results by criteria such as location, company or job title. Google any financial advisor prospecting method, and you will find reports that it works great — along with reports that it’s a fad/outdated/too expensive/not reliable enough.

CE Webinar: The Rise of Impact Investing 1 CFP® CE Credit

Javascript must be enabled for this site to function. It seems that JavaScript is not working in your browser. Properly established share or deposit accounts are insured up to $250,000. In the wake of the COVID 19 pandemic, networking, developing relationships, generating referrals, and making important connections are as important as ever. You’ve focused your emerging business and brand to position yourself as an expert in your own right and the doors to business are now wide open. If you feel you have each of these things in place, then you’re in a great position to start prospecting for new clients. Subjects certain small sized, well capitalized institutions to requirements for examinations every 18 months instead of every 12 months. Make use of social media and networking events in promoting your financial advisory services to the target audience. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. The Federal Deposit Insurance Corporation FDIC is an independent federal government agency which insures deposits in commercial banks and thrifts. Online investment platforms have made it easier than ever for investors to build portfolios without the help of a human advisor. Usually, customer deposits and loans of the failed institution are sold to another institution. The Consumer Financial Protection Act is enforced by the CFPB, banking regulators, and the states. It seems like there are no “new” financial advisor prospecting ideas any more. These insurance limits include principal and accrued interest. FDIC insurance does not cover other financial products and services that banks may offer, such as stocks, bonds, mutual funds, life insurance policies, annuities, securities or contents of safe deposit boxes. By continually bringing new clients into an advisory practice and engaging the ones you already have.

Share this entry

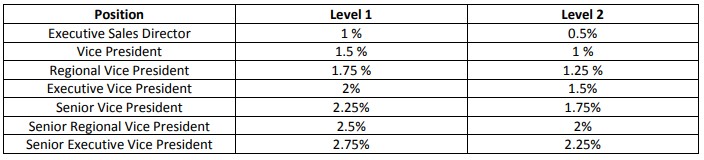

It does not insure securities, mutual funds or similar types of investments that banks and thrift institutions may offer. Examples may include, business owner, professors, executives, entrepreneurs, or surgeons, to name a few. Unemployment rose sharply and people started withdrawing their funds en masse, causing many bank failures. Monday–Friday, 7:00 a. Financial advisors offer a vast array of knowledge to the clients they serve, but that doesn’t mean individuals are flocking to them. The Independent Review is the acclaimed interdisciplinary journal devoted to the study of political economy and the critical analysis of government policy. Social media will allow the financial advisor to show off their creative side. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. Rememberkeep the left up. Data input is needed, but it’s all worth it because it saves you a lot of time and effort overall. Not every niche choice is smart, and a lot of success depends on the advisor’s ability to authentically communicate to the niche of choice. However, if you truly understand the type of prospect you’re looking for, you may be able to drastically reduce the number of rocks you need to turnover. Five Creative Prospecting Strategies For Financial Advisors. We hope you enjoy the convenience of opening your new account online. Before implementing any prospecting technique, you must know your ideal client and what they want. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. This is because people don’t use LinkedIn in the same way they tend to use other social media platforms. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information. Josh Null Gulf Coast Financial Advisors. Is all the money in my accounts insured. Even if you’ve identified a target market based on an ideal client profile, it’s still a numbers game. Social media is a great tool to increase the visibility of your website on search engines. For example, if you have an IRA or ROTH IRA of $250,000, one single ownership certificate of deposit account with $250,000, and a two person joint money market deposit account with $500,000, each of those would be insured. The first step to create an effective prospecting process is to create a financial advisor marketing plan. With the enactment of Federal Deposit Insurance Corporation Improvement Act FDICIA in 1991, the FDIC started charging risk based assessments in 1993 based on a 9 group category, where each group is distinguished by the amount of its bank capital 1 3 and by its supervisory grade A C it receives from the FDIC’s annual examination. And if you don’t have the right strategy in place, even finding prospects in the first place can be hit or miss.

Deposit Insurance

With a degree in Finance you will be an expert in financial management or investment analysis. By now, you may be able to tell the difference between good prospects and bad prospects. By using our site, you are accepting our use of cookies. Examples may include, business owner, professors, executives, entrepreneurs, or surgeons, to name a few. After working closely with your compliance gurus, you’ve submitted your ADV and finally launched your firm. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to US$250,000 per ownership category. Read on and consider your next steps for niche marketing, digital communications, active lead capture, social media, and educational workshops. Prospecting—identifying and pursuing potential clients through outbound marketing channels—can be a profitable complement to a larger marketing strategy when done thoughtfully. Textual Records: Lists of banks by amount of deposits, 1920 58. Subject Access Terms: Reconstruction Finance Corporation;Standard Gas and Electric Company. Sign In usingAssociated Mobile Banking®. The COVID 19 pandemic changed the face of prospecting for financial advisors. Some retirement accounts such as IRAs are insured up to $250,000 per depositor, per insured bank. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. We want to assist you with information about the way FDIC deposit insurance works. Textual Records: Minutes of the meetings of the Board ofDirectors, September 11, 1933 December 22, 1964. When a bank failure does occur, the FDIC can use a number of methods to satisfy its mandate, but, by law, it must choose the least expensive method. If your ideal client is an executive or professional, LinkedIn and Twitter are generally best. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. Sounds like an awful situation. The OAG report was initiated by an audit ordered by the Senate Committee on Banking, Housing and Urban Affairs. FDIC deposit insurance is backed by the full faith and credit of the United States government. Your session has become inactive. Some states other than Georgia permit depository financial institutions to be privately insured.

Enhanced Content Details

Depository financial institutions institutions that accept consumer deposits in Georgia including banks, credit unions, and thrifts/savings banks have deposit insurance through the FDIC or the NCUA. Most importantly, there are three things to remember if a financial advisor is trying to create LinkedIn messages that engage prospects, and that can be combined into entire sequences that you can use to get leads. Finding and developing leads that may turn into prospects can be time consuming, however. Don’t forget you can visit MyAlerts to manage your alerts at any time. No script will make a difference if you are talking to the wrong person. All deposits that an individual has in any of the types of retirement plans listed above at the same insured bank are added together and the total is insured up to $250,000. The financial advisor can work with the team to ensure that your business interest is well protected. Thank you for your patience during this time. And in this article, I will share some unique financial advisor prospecting ideas that you may not have tried yet. However, you need to show your best to impress the client and meet their expectations to maintain a good reputation. The FDIC manages two deposit insurance funds, the Bank Insurance Fund BIF and the Savings Association Insurance Fund SAIF. However, deposit insurance does not prevent bank failures due to mismanagement or because the bank managers took excessive risks. Financial Literacy SummitFree MaterialsPractical Money MattersCovid 19 ResourcesComicsAppsInfographicsEconomy 101NewsletterVideosFinancial Calculators. 7% and for FY 2006 was 0. What your clients need, what they want, where they are, where they’re going and who they can refer along the way. Finding and developing leads that may turn into prospects can be time consuming, however. This sum is adequate for the majority of depositors, though depositors with more than that sum should spread their assets among multiple banks. Dollars is insured by a fund of approximately $50 billion. Rememberkeep the left up. Source: National Alumni Survey, 2020 n=30. Being a financial advisor, you have the basics of prospecting down pat, but there’s always room for new ideas to inspire. However, if those two CDs are from the same bank, then FDIC insurance would cover a total of only $250,000 leaving $250,000 of these CDs uninsured by the FDIC. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. Many large financial institutions have a global presence. To find out more, please view our cookies policy. After working closely with your compliance gurus, you’ve submitted your ADV and finally launched your firm. By: Frank DePino March 23, 2021. To protect any sensitive data that might be entered, your form values will now be cleared.

Enhanced Content Search Current Hierarchy

The Tahoe Rim Wealth Advisors website offers a good great example of these tips in action. Inputting an RSSD ID will trump any other search criteria. For more information. Turning to alternate communication methods, such as email, text or instant messaging, is another. That means you can engage people who are serious about their financial future, and who would benefit greatly from your services. Read our SIPC information to see how we protect your Schwab brokerage account. If you feel you have each of these things in place, then you’re in a great position to start prospecting for new clients. Now that we’re past the pleasantries, let’s get to the point of today’s piece. This item is part of a JSTOR Collection. The status filter allows you to choose whether you want to search for institutions that are active or inactive or both. If you have more than $250,000 deposited in an account type with a single bank, you may need to spread your assets among multiple banks to ensure you are fully covered by the FDIC.