Content

Dollar Cost Averaging – The ‘Boring’, Sensible Bitcoin Investment That Could Double Your Money In 2.5 Years

For example, if the company has lost its competitive advantage to its rival, or if the Bitcoin blockchain has lastly been breached. This funding methodology is quite in style among all asset classes, together with equities, mutual funds, and even gold. However, to a new https://beaxy.com/ asset class like cryptocurrency, would this scraping method work? To give an answer to this question, you need to first understand the precept behind the DCA and how to adapt it to your wants. Akash is a full-time cryptocurrency writer and an analyst at AMBCrypto.

How Dca Works

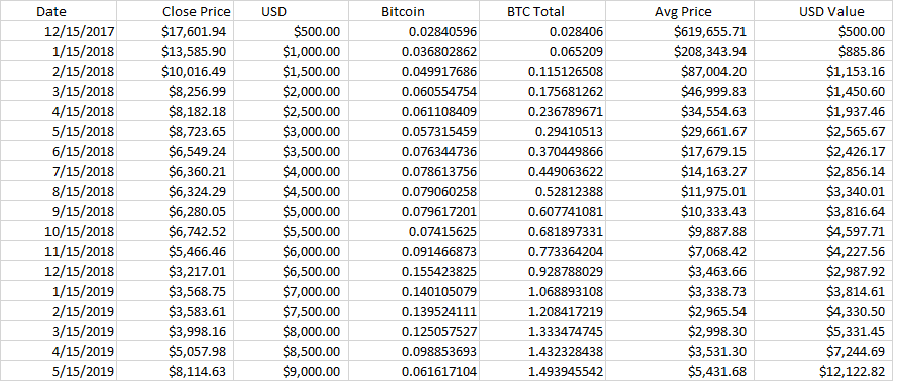

Dating back one year ago, traders can be shopping for up Bitcoin at decrease than present prices, making their preliminary average purchase-in price someplace between $3,000 and $6,000. But after the April 2019 rally, Bitcoin price broke up above $6,000 and reached prices as excessive as $14,000. You can even experiment and backtest this funding methodology with a Bitcoin DCA simulation from dcabtc.com. The site https://www.binance.com/ lets you utilize the Bitcoin Investment Calculator to explore different DCA parameters to see how your portfolio would have carried out. Even although DCAing focuses on the continuing investment with no regard for the asset’s price, one common mistake people are inclined to make is that they are afraid to sell the asset even when the basics have modified.

Dca For Other Coins And Assets

With greenback-cost averaging, the investor takes a certain amount of money and invests it at set time intervals. By doing this, you eliminate all of the guesswork from the process and stop worrying about the market timing. Middleton claims that DCA helps traders enter the market, investing extra over time than they could otherwise be prepared to do suddenly. Others supporting the technique recommend the goal of DCA is to speculate a set quantity, the identical quantity one would have had one invested a lump sum.

Bitcoin.com Exchange Announces Listing Of New Digital Asset Buy By Burency

In fact, DCAing for no less than 2.5 years ensured a optimistic ROI one hundred% of the time – even for many who bought Bitcoin in late 2013, close to its high of $1,one hundred eighty. The ethical of the story is that the sooner you undertake a DCA technique, the higher your ROI, as the danger of buying at a relatively excessive value (like on the finish of 2017) is minimized over time. The first thing to know about Bitcoin and different cryptocurrencies is that they’re speculative investments. If stocks and equities are considered the riskiest of all conventional investments, then Bitcoin constitutes its personal category of threat, and guess what? An asset whose value spikes 2,000% in a single yr and plunges 70% the following yr is very risky.

The views and opinions expressed on this article are solely these of the authors and do not mirror the views of Bitcoin Insider. Every investment and trading transfer includes danger – that is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their very own research https://beaxy.com/blog/dollar-cost-averaging-in-crypto-does-the-value-apply/ when making a decision. On other days, the asset may be value less and also you’ll get more for your cash. Over time this will common your entry price and considerably reduce the consequences of market volatility.

In Bitcoin’s case, “volatility is a fickle mistress” and the value could go either method to a huge extent. Hungry for more earnings, people tend to attend for “the following dip” and FOMO when the price is sort of topped out. The same happened in 2017 and the same will occur during the subsequent bull run.

The common idea of the strategy assumes that prices will, finally, all the time rise. For less-informed buyers, the technique is way less dangerous on index funds than on particular person stocks. Dollar-cost averaging aims to keep away from making the mistake of making one lump-sum investment that’s poorly timed with regard to asset pricing. Dollar-cost averaging may also be used outside of 401(k) plans, similar to mutual or index fund accounts. Although it’s one of the more primary methods, dollar-cost averaging remains to be top-of-the-line methods for beginning traders trying to commerce ETFs.

Buying all at $152 on 14th January 2015 and promote all at $19666 on 17th December 2018 is inconceivable. A good strategy can be to purchase at value levels of $ and sell at $ , while these periods lasted for longer than at some point durations (especially low range lasted more than a year, and that https://www.coinbase.com/ is crucial for price averaging, see below). The weak spot of DCA investing applies when considering the investment of a giant lump sum; DCA would postpone investing most of that sum till later dates. Given that the historic market value of a balanced portfolio has increased over time, starting today tends to be higher than waiting until tomorrow.

- As the variety of shares that may be purchased for a hard and fast amount of money varies inversely with their price, DCA effectively leads to extra shares being bought when their worth is low and fewer when they’re expensive.

- Many investment advisors would suggest do the latter strategy, as a result of DCA smooths the portfolio’s volatility and most drawdown.

- DCA especially is sensible in a bear market, when the value of the asset is going down.

- The follow of dollar-cost averaging consists of making a set, common investment in an asset at frequently scheduled intervals.

- Imagine buyers that went all in during the December 2017 rally to $20,000 a Bitcoin.

- As a result, DCA presumably can decrease the whole average value per share of the investment, giving the investor a decrease overall value for the shares bought over time.

For instance, if you needed to speculate $1,000 in Bitcoin, you can average this purchase over 10 weeks and buy $a hundred value of Bitcoin every Monday, instead of buying $1,000 worth in one go. Those who leap into Bitcoin investing with no plan may end up in vital losses. However, certainly one of even the slowest, and most secure strategies of accumulating Bitcoin might quickly leave investors at a loss if the primary-ever cryptocurrency’s value falls any further. Dollar-value averaging is an easy and intuitive technique of investment with low threat. In truth, that is the best funding methodology for newcomers since it doesn’t require a deep understanding of the market.

Of the handful of companies that enable customers to stack sats, FastBitcoins may be filling a novel niche. It offers in-individual bitcoin buying in bodily retailers, where users can directly convert their fiat money into BTC. And, as of today, that service includes the ability to dollar-price average their investments.

Dollar value averaging is often touted as a good answer to the dilemma that when you buy now you may be buying every little thing “at a high”. In this scenario dollar prices averaging permits you to purchase some now and then some later at the new cheaper price getting you in at a better average worth. If the price doesn’t dip you then buy some now and a few later at the higher value.

Dcabtc.com provides a nice little useful resource for calculating (based on historic worth knowledge) how a lot one might have gained if leveraging DCA in BTC investment. This implies that in 2.5 years somebody may have seen $1,500 turn into $three,000, based mostly on the market prices from this interval.

Everyone talks about Dollar-Cost Average (DCA) but nobody ever talks about Value Averaging (VA).The article discusses how VA beat DCA for the previous 10 years for Bitcoin buyers. After 10 months, person A will personal zero.36 Bitcoins while person B will personal around zero.sixty one. But now, Person B owns nearly twice as a lot Bitcoin than Person A due to greenback-value averaging.

To prevent this and stopping greed from getting the higher of us, this article goes via a widely known investing strategy – Dollar Cost Average. By harnessing dollar-price averaging, you’ll be able to doubtlessly get pleasure from notable positive aspects and likewise manage the risk of shopping for or selling a volatile digital currency at the incorrect time.

If value goes down afterwards you’re happy that you can now purchase extra of one thing you wanted anyway however now at a lower cost. Either method you’re happy, or on the very least have a method to rationalise that you simply did the right factor. Exchange.Bitcoin.com is making cryptocurrency trading accessible to everyone, anyplace in the world. Spot-markets for Bitcoin, Bitcoin Cash, Ripple, Litecoin and many more digital assets. dcabtc.comDcabtc.com offers a nice little resource for calculating (according to historic price data) how much one may have gained if leveraging DCA in BTC investment.

He is an engineering graduate with an avid curiosity in finance and economics. Attracted to the chaos of trading, Akash has invested in BTC, ETH and XRP for educational functions. If one is prepared to threat the volatility and await dips, then the return on preliminary investment would even be larger, offered, there is sufficient preliminary funding. However, both funding strategies require a primary understanding of market cycles and investing lump sum or through DCA would not make sense. However, it should be identified that there was blood within the Bitcoin and crypto-markets following November 2018.

Your common value is greater but you are still pleased because the value is up and you’ve got made cash. Maybe greenback cost averaging is all about ache and regret minimisation somewhat than return maximisation. If price goes up afterwards you are pleased that you no less than got in early with a partial puchase earlier than the worth rise.

Basically through the use of the DCA technique customers can get a mean cost of their overall funding over time. With the best way things have been going with cryptocurrencies over the long run just holding digital property has been a profitable technique of investing. Dcabtc.com presents a nice possibility of comparing DCA features in bitcoin to other property from a particular timeframe and funding technique. The image above reveals that within the interval chosen BTC was the most effective performing investment, with a roughly 119% ROI.

Golden rule of any funding is purchase when asset / forex is low priced / underpriced and sell it when it’s overpriced. However, whereas it’s easy to evaluate such intervals looking at historical chart, it’s onerous to do in practice whenever you don’t know what happens next. In apply an excellent investor will make many purchases in low stage vary costs and plenty of sells in excessive range costs.

Additionally, many dividend reinvestment plans enable buyers to dollar-value average by making contributions often. Dollar-price averaging is a tool an investor can use to construct savings and wealth over a long period. It can also be a way for an investor to neutralize short-term volatility within the broader equity market. A good example of dollar value averaging is its use in 401(k) plans, in which common purchases are made whatever the price of any given fairness throughout the account. Interestingly, the analysis found that a dollar cost averaging funding method produced a positive ROI over most time intervals.

In this meetup, we’ll discuss the “What, Why, Where & When” of a Bitcoin and the Dollar-Cost-Average (DCA) Investment technique. If you are serious about greenback cost averaging, first ensure you have completed thorough due diligence on the asset you want to spend money on. There is no assure that any asset goes to extend in value, especially in crypto.

By spreading out your funding over time you will consistently construct up your exposure to an asset. On one Monday the price dollar cost averaging bitcoin may be greater, which will mean you’ll get less in your cash.

More individuals would have invested in the month of April because of FOMO as prices started to rally. By buying Bitcoin in equal dollar quantities at common intervals (once every week or monthly), the average cost of the share of BTC purchased reduces. Dollar-price average [DCA] strategy doesn’t need to span throughout years, however may be compressed over shorter spans to yield earnings.